Crypto bubbles happen when prices of digital coins rise very fast and then fall quickly. People get excited, prices shoot up, and many buy in. But these bubbles often pop. If you are into crypto, it’s good to know how bubbles work. This helps you stay safe and avoid losing money.

Contents

What Are Crypto Bubbles?

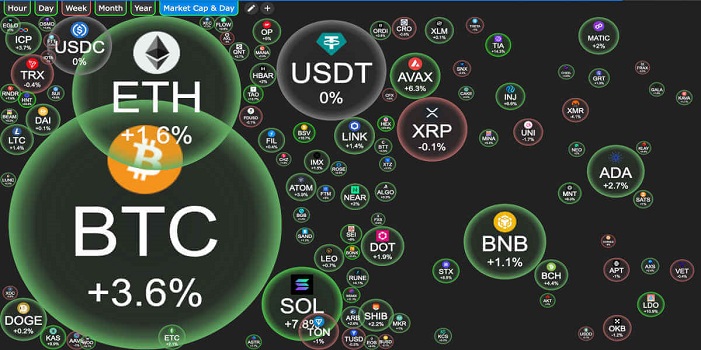

A crypto bubble is when a coin’s price grows too fast, mostly due to hype. This hype is not based on real value. Later, people see the prices are too high. They start selling, and the price drops a lot.

Signs of a Crypto Bubble

- Prices rise too fast without a strong reason.

- Lots of media talk and online hype.

- Many people start buying, even if they know little.

- Then comes a sharp fall in price.

Real-Life Crypto Bubbles

Bitcoin in 2013

Bitcoin went from $13 to $1,100. That was big. But in 2014, rules and hacks made it crash.

ICO Boom in 2017

Lots of new coins came out through ICOs. Ethereum jumped from under $10 to $1,400. Many projects failed. In 2018, prices fell fast.

DeFi Surge in 2020

Decentralized Finance (DeFi) became trendy. Some coins had value, but many were just hype. Prices dropped after a while.

Why Do Crypto Bubbles Happen?

1. Too Much Hype

People hear about fast gains and rush to buy. That makes prices go up more.

2. Big Owners (Whales)

Some people own a lot of coins. When they buy or sell, prices move a lot.

3. Rule Changes

New government rules can scare people. That fear causes selling.

4. New Tech Buzz

A new coin or idea can excite people. If it fails, trust is lost and prices fall.

How Our Minds Play a Role

FOMO (Fear of Missing Out)

People see prices rising and buy late, afraid to miss out.

Following the Crowd

If everyone’s buying, others join in without thinking.

Too Much Confidence

After one win, people think they will always win. So they take big risks.

What Happens When a Bubble Pops?

Big Money Losses

Late buyers lose money when prices crash.

Market Becomes Wild

Prices change quickly. It’s hard to know what will happen.

Governments Step In

Rules get stricter. This can slow the market.

How to Stay Safe During a Bubble

1. Spread Your Money

Don’t put everything in one coin. Use a mix—stocks, savings, etc.

2. Limit Your Risk

Use tools like stop-loss orders. Don’t bet more than you can afford to lose.

3. Do Some Homework

Read about the coin. What does it do? Who is behind it?

4. Think Long-Term

Invest in coins you trust. Avoid chasing fast gains.

Expert Advice

“Bubbles form when people act on emotion, not facts,” says a crypto expert. “If you’re chasing trends, you might lose. Smart investors focus on real value.”

Easy Tips to Avoid Crypto Bubbles

- Always do research.

- Don’t follow others blindly.

- If it sounds too good, it might be fake.

- Stick to your plan. Stay calm.

Conclusion

Crypto bubbles are part of investing. They can be risky but also offer lessons. When you learn the signs, you can avoid trouble. Just remember: research, spread your money, stay calm, and skip the hype.

FAQs

Q1: What is a crypto bubble?

It’s when coin prices go up too fast and crash later.

Q2: How do I spot a bubble?

Look for fast price hikes, hype, and many new buyers.

Q3: Why do bubbles pop?

Prices rise too high. Then people sell in fear, and prices fall.

Q4: How do I stay safe?

Spread your money, limit risk, do research, and think long-term.

Q5: Are bubbles always bad?

Not always. They show trends. But they remind us to be smart and careful.