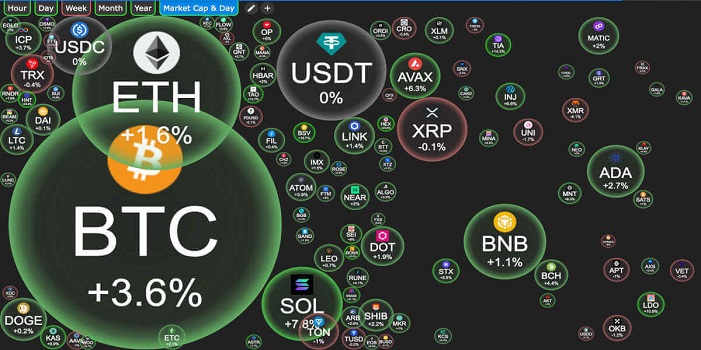

A crypto bubble happens when the price of a cryptocurrency rises too high, too fast, beyond its real value. This often occurs when many investors rush to buy it, hoping to make a profit. However, when excitement fades, the price drops sharply, leaving many people with losses. This pattern has repeated in the crypto world several times.

One of the most famous crypto bubbles was during the 2017 Bitcoin boom. Bitcoin’s price soared to nearly $20,000 but then crashed to below $4,000 within a year. A similar event happened in 2021 when Bitcoin reached almost $69,000 before falling again. These sudden rises and crashes are what make crypto bubbles dangerous yet fascinating.

Contents

How Do Crypto Bubbles Form?

Crypto bubbles form when a mix of factors drive prices up rapidly. These include:

- Hype and FOMO (Fear of Missing Out): People see others making money and rush to invest.

- Media Attention: Positive news stories attract more investors.

- Speculation: Investors buy crypto hoping its price will rise, not because it has strong fundamentals.

- Low Regulation: Lack of strict rules allows manipulation and rapid price swings.

- Market Manipulation: Big investors (whales) can push prices up by buying large amounts and then selling at a peak.

When these elements align, the crypto market heats up quickly, creating a bubble that eventually bursts when confidence disappears.

Signs That a Crypto Bubble Is About to Burst

Recognizing a bubble before it bursts can help investors avoid losses. Here are some warning signs:

- Extreme Hype: When social media and news platforms constantly talk about a certain cryptocurrency.

- Unrealistic Price Growth: If prices rise much faster than usual without a solid reason.

- New Investors Flooding In: When inexperienced people invest just because they see others making money.

- Big Investors Cashing Out: If large holders start selling, it could signal a crash.

- Regulatory Warnings: When governments announce stricter regulations, prices often drop.

Famous Crypto Bubbles in History

1. Bitcoin Bubble of 2017

In 2017, Bitcoin skyrocketed from $1,000 to nearly $20,000 in less than a year. Many believed it was the future of finance. However, in early 2018, Bitcoin crashed to below $4,000, wiping out billions of dollars in investments.

2. The ICO Bubble

During 2017-2018, Initial Coin Offerings (ICOs) were extremely popular. Many new cryptocurrencies were launched, and people invested in them hoping for big returns. However, most ICOs failed, and their prices collapsed, leading to huge losses.

3. The 2021 Crypto Boom and Crash

In 2021, Bitcoin reached nearly $69,000, and the entire crypto market hit record highs. However, by 2022, a major crash occurred, wiping out trillions of dollars. The collapse of major companies like Terra Luna and FTX accelerated the downturn.

How to Protect Yourself from Crypto Bubbles

To avoid falling victim to a crypto bubble, follow these strategies:

- Do Your Research: Understand a cryptocurrency’s real value before investing.

- Avoid Hype: Just because everyone is talking about it doesn’t mean it’s a good investment.

- Diversify Your Portfolio: Don’t put all your money into one cryptocurrency.

- Use Stop-Loss Orders: Set a limit where you automatically sell if the price drops too much.

- Stay Updated on Regulations: Government policies can heavily impact crypto prices.

Conclusion

Crypto bubbles are a natural part of the cryptocurrency market. While they can create opportunities for big profits, they also come with huge risks. By understanding how these bubbles form and burst, investors can make smarter decisions and avoid financial losses.

FAQs

1. Are crypto bubbles the same as stock market bubbles?

Not exactly. Both involve rapid price increases followed by crashes, but crypto bubbles are usually more volatile due to less regulation and more speculation.

2. Can a crypto bubble last forever?

No. Bubbles always burst eventually when reality catches up with speculation.

3. How can I tell if a cryptocurrency is in a bubble?

Look for extreme hype, rapid price increases, and a flood of new investors who don’t fully understand the market.

4. What happens when a crypto bubble bursts?

Prices drop sharply, leading to massive losses for those who bought at the peak.

5. Should I invest in cryptocurrency during a bubble?

It’s risky. If you do, be cautious and never invest more than you can afford to lose.